Key Takeaways

A communication gap exists between what advisors think their clients are concerned about and what their clients are actually concerned about.

In turbulent times, clear, consistent communication can make the difference between a client staying the course and a client abandoning the long-term strategy you’ve helped them to build.

Consider building a volatility communication plan, reaching out to clients proactively, and providing opportunities to meet off-cadence.

Annuities can be used as a buffer to give clients the peace of mind to stay invested in the rest of their portfolio, even when emotions are running high.

During periods of market volatility, investors often find themselves gripped by fear, uncertainty, and doubt. The most diligent advisors remind us that our ability to stay calm, lead with clarity, and communicate consistently can make the difference between a client staying the course and a client abandoning their overall strategy in favor of short-term emotional (and seemingly financial) security.

Understanding financial markets is crucial to making informed investment decisions during volatile times. But that deep market knowledge isn’t enough—the real success lies in how well you are able to translate complexity into client confidence.

The Emotional Risk Behind Market Volatility

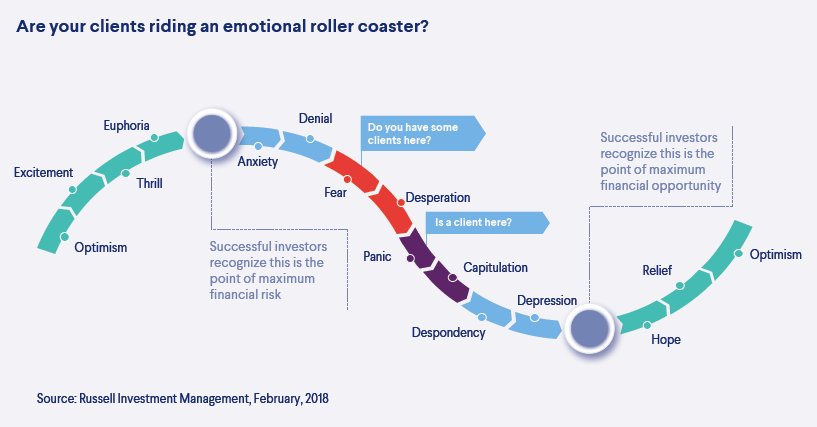

Volatility doesn’t just affect account balances—it also affects behavior. And for many clients, that behavior is shaped more by fear than logic, which can potentially lead to rash decisions. We’ve all seen investors who react emotionally to stock market volatility, either by exiting the market or remaining passive, which can hinder their long-term financial goals.

These emotional swings can lead to poor decisions, like selling at the wrong time or sitting on the sidelines. Loss aversion is real – behavioral research tells us that people feel the pain of losses twice as intensely as the joy of gains.1 That emotional pull leads many clients to abandon financial plans that were built for the long haul.

It's our job to work with our clients to reframe that fear with clear perspective. We can use long-term market insights and examples to show clients that while markets may be volatile in the short term, optimism will return, as we see from each major historical downturn and subsequent recovery over the past 100 years.

Another technique is to shift your language: Instead of asking “Does volatility impact your investment thinking?”—which will always be a yes—ask “How is this volatility affecting your thinking?” That small change opens the door to real conversation.

Because usually at the heart of their anxiety isn’t the market volatility—it’s the wedding they want to pay for, the retirement home of their dreams, or perhaps the future they’ve envisioned that suddenly seems to be at risk.

Bottom Line: The best advisors don’t just manage portfolios—they manage perspective.

Positioning Yourself as a Resource: What Advisors Can Do Now

Our clients don’t need someone to predict market conditions. They need someone who can help them tune out the noise and focus on what they can control.

And that starts with how you communicate.

A study done in 2024 by the Financial Planning Association (FPA)2 highlighted that there's a gap between what financial planners assume their clients are worried about financially, and what actually keeps clients up at night. This gap in understanding presents a tremendous growth opportunity for you—listening deeply, uncovering the underlying factors motivating your clients' actions, and developing a plan that addresses those concerns can deepen client relationships and build lasting trust.

When it comes to talking to clients during volatility, we find the most successful advisors bridge that gap with proactive outreach, transparency, and empathy. One advisor we know has never done advertising—his practice grows purely from referrals. The reason? His clients hear from him when it matters. Every client has the opportunity to hear what's happening through his lens—a bigger, broader and more accurate lens than their own."

Here’s what his volatility communication plan looks like, in addition to his normal client meeting cadence:

Start with a live meeting or call

Follow up with email updates or messages, based on client preference

Clients can opt out, but most don’t—they value hearing from someone who sees the bigger picture

Building Your Volatility Communication Plan: Lead with Empathy

You don’t need a flashy strategy. You need a consistent one. And it should flex when markets get unpredictable.

Before diving into a sample messaging framework, think about your current client communication cadence:

Do you meet quarterly, semi-annually, or annually to review their plan? While this may work when markets are stable, it’s worth giving clients the option of increased communication during periods of volatility.

Proactively let clients know you’re here to help.

Provide options to meet off-cadence and always allow clients to opt out of additional communications.

Then, follow this three-step approach to help structure your client communications during market turbulence:

Audit your past performance: What worked during the last downturn? What client feedback did you receive?

Refine your messaging: Use scenario-specific templates for market dips, rebounds, and extended volatility. Align your language with the various investment products your clients are invested in.

Operationalize your outreach: Assign responsibilities to your staff so it’s clear who is expected to schedule email sends, coordinate live events, and respond to client questions. Build a content plan with a mix of your outreach materials; this allows you to schedule your materials, from email campaigns to webinars, without day-to-day input from your team. Set thresholds (e.g., market drops over 10%) that trigger client touchpoints.

Bottom Line: When you communicate with clarity and lead with empathy, your clients won’t just hear from you—they’ll remember you.

How Annuities Can Offer a Buffer During Uncertain Markets

When markets wobble, clients look for something that doesn’t. Annuities aren’t just about returns. They’re about reliability—especially for clients focused on income and downside protection. They can give clients the peace of mind to stay invested in the rest of their portfolio, even when emotions run high.

Key Benefits of Fixed and Variable Annuities in Volatile Markets

Protection from market losses: Fixed indexed annuities (FIAs) protect principal while still offering upside potential—crucial when clients are rattled.

Reliable income streams: Income annuities offer predictability. And when essential expenses are covered, clients are less likely to panic.

Improved investor behavior: A study by DALBAR on variable annuities showed that investors tend to perform better in subaccounts held within annuities versus outside.3 Why? Because the insurance wrapper promotes long-term thinking and discourages emotional selling.

Diversified retirement income: Annuities reduce sequence-of-returns risk by offering guaranteed income outside of market-based assets.

Focus on the practical ways to use annuities when planning with clients, like for essential expense planning. A client who needs $4,000/month for must-have expenses could lock that in with a guaranteed income product, leaving the rest of their assets to stay in the market with confidence.

Not every client needs an annuity—but many benefit from one. The key is starting with the client’s goals, not the product. Always check suitability based on time horizon, risk tolerance, and income needs. Refer to current product guides to stay accurate.

Final Thoughts: Market Volatility Is Inevitable—Panic Is Not

Market volatility is part of the journey. But it doesn’t have to lead to panic. When we lead with empathy, communicate proactively, and use tools like annuities to anchor the plan, we can help clients make smart, confident decisions—even in uncertain times. Having a defined long-term strategy is crucial to handling market volatility and maintaining stability in the minds and hearts of your clients.

1The Decision Lab, “Why Do We Buy Insurance?”, https://thedecisionlab.com/biases/loss-aversion.

2 Financial Planning Association, “Financial Planner Perspectives on a Profession in Transition,” 2024, https://www.financialplanningassociation.org/learning/research/client-communication.

3DALBAR, “Quantitative Analysis of Investor Behavior Variable Annuities,” 2024.

Disclosures

Delaware Life does not provide tax or legal advice. Any tax discussion is for general informational purposes only. Clients should refer to their tax professional for advice about their specific situation.

Delaware Life Insurance Company (Zionsville, IN) is authorized to transact business in all states (except New York), the District of Columbia, Puerto Rico and the U.S. Virgin Islands. Annuities are issued by Delaware Life Insurance Company and variable annuities are distributed by Clarendon Insurance Agency, Inc. (member FINRA) located at 230 3rd Avenue, Waltham, MA 02451. All companies are subsidiaries of Group 1001 Insurance Holdings, LLC and are responsible for their own financial condition and contractual obligations. Guarantees are backed by the financial strength and claims-paying ability of the issuer. Product availability and features may vary by state.

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC.