Social Security retirement benefits are a core part of most retirement income plans—but when divorce enters the equation, the rules can get confusing fast. The Social Security Administration projects that in 2050 more than 80% of divorced spousal beneficiaries aged 62 or older will be women.1 That’s especially true for women who may have spent years out of the workforce, working part-time or supporting a spouse’s career.

Advisors are often the first person a client turns to with questions—whether they’re ready to file or simply trying to understand what’s possible. You don’t need to be a Social Security expert to make a real difference. A thoughtful conversation and a well-timed referral can go a long way.

Here’s a practical look at how to guide divorced clients through their options, with a special focus on women who may be eligible for spousal or survivor benefits.

Why Social Security Often Matters More for Women

Many women rely more heavily than men on Social Security in retirement. That’s largely because they tend to live longer, earn less over their lifetime, and are more likely to take time away from work to care for others.2 Retirement planning is crucial to ensure they maximize their benefits and secure their financial future.

In the wake of a divorce, that reliance can become even more pronounced. For many clients, especially women navigating retirement solo, a divorced-spouse benefit may be one of the steadiest sources of income they’ll have. Helping them understand what’s available—and how to claim it strategically—is incredibly important.

Questions to Help Frame the Conversation

Advisors are in a unique position to discuss Social Security benefits in the context of the rest of their clients’ portfolio. Some questions that could assist a recently divorced client center the conversation around Social Security could include:

| Question | Answer |

|---|---|

| Are you planning to rely on your own benefits or an ex-spouse's? | If relying on an ex-spouse's, ensure the client meets marriage duration and age criteria (see below). |

| Have you compared the potential benefits at different claiming ages? | Show estimates for early (age 62), full (66–67), and delayed (up to age 70) claiming scenarios. |

| Are you currently married or remarried? | If remarried, client generally cannot claim ex-spouse benefits unless the later marriage has ended. |

| Is your ex-spouse at least 62 years old? | Client cannot claim on the ex-spouse's record unless the ex is at least 62. |

| Do you anticipate needing income before full retirement age? | May lead to early (reduced) claiming; advisors should review earnings limits, income needs, and other available assets. |

Advisors who proactively bring up the various scenarios and regulations tied to Social Security income and benefits will be best suited to help their clients long before retirement hits.

Eligibility: The 10-Year Rule and Other Basics

To claim benefits on an ex-spouse’s record, clients typically need to meet specific eligibility criteria:

The marriage lasted at least 10 years.

The client is at least 62 and currently unmarried.

The ex-spouse is at least 62 and eligible for Social Security (even if they haven’t filed yet)

If the divorce has been finalized for two years or more, the ex-spouse doesn’t need to have filed for the other to start claiming benefits.

There’s also a persistent worry that claiming a benefit based on an ex-spouse’s record might affect that person’s payments in the future or trigger a notification to that ex. That’s not the case. These claims are confidential and don’t reduce anyone else’s benefit. This flexibility can be a meaningful lifeline—especially when emotions or privacy concerns are still in play.

Some benefit payouts could be subject to the family maximum; however, the benefits for divorced spouses (including surviving divorced spouses) are never reduced. (Please note: The rules for calculating family maximum benefits are complicated, especially in particularly complex cases; please consult with the Social Security Administration.)

In addition, surviving spouses, including surviving ex-spouses, can start collecting as early as age 60 (50 if disabled), although the benefit will be reduced for age. Payments start at 71.5% of the ex-spouse’s benefit and increase the longer clients wait to apply. For example, clients might get:

Over 75% when they file at age 61.

Over 80% at age 63.

Over 90% at age 65.

They can get up to 100% when they reach and file at their “Full Retirement Age for Survivor Benefits” (between ages 66–67).

When Clients Haven’t Worked Much—Or at All

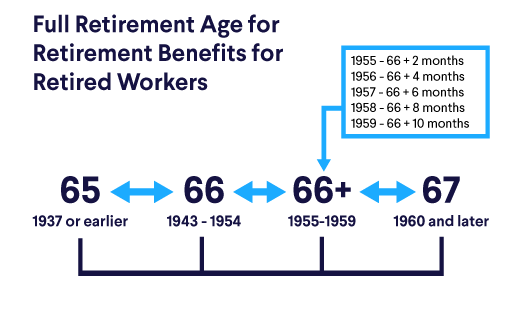

Clients who haven’t earned enough retirement credits on their own may still be eligible for up to 50% of an ex-spouse’s full benefit at full retirement age (FRA). For many homemakers and caregivers, that can provide a meaningful financial base. Social Security spousal benefits (whether for a current or divorced spouse) are based on the primary insurance amount (PIA) of the worker’s record. The PIA is the monthly benefit the worker is entitled to at their full retirement age (FRA)—which is between 66 and 67, depending on birth year.

Full retirement age for retirement benefits for retired workers:

Even clients with a modest work history might find that a divorced-spouse benefit is higher than their own earnings record. That’s why it’s important to review both benefit estimates before filing. If the client is also eligible for their own benefit, upon application the SSA will determine eligibility for both amounts and pay the higher one. In some cases, clients mistakenly believe they can "combine" their own benefit with the spousal amount—but they’ll only receive the higher of the two, not both.

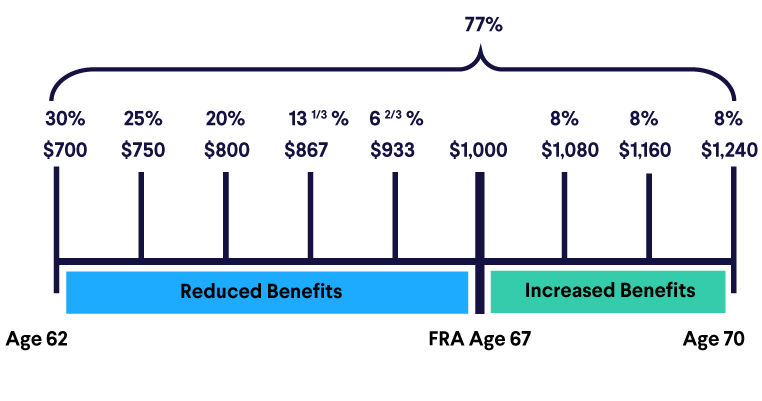

One point to note: Every time a beneficiary files before full retirement age, the benefits will be reduced because of the early filing. In general, if a worker with retirement benefits and FRA of 67 claims at age 62, the benefit will be reduced by 30%; if claimed at age 70, the benefit will increase by 24% because of delayed retirement credits.

Real-Life Examples to Ground the Conversation

Here are a few common scenarios that can help make these rules easier to explain.

Understanding these scenarios can also highlight the potential for a higher benefit when claiming Social Security retirement benefits based on an ex-spouse's work record.

Scenario 1: The Homemaker

Angela, 66, was married for 20 years, raised two children, and never worked outside the home. Now divorced and approaching her FRA, she may be eligible to receive half of her ex-spouse’s full retirement benefit as a spouse's benefit.

Scenario 2: The Part-Time Worker

Sophie, 62, worked part-time during her marriage and has a lower benefit amount than her ex-spouse. Because her own benefit is below 50% of her ex’s, she can claim the higher amount as a divorced spouse. However, it's important to consider the financial implications of early claiming, as claiming benefits before the standard age can result in a reduction of those benefits. Depending on Sophie’s employment status and expenses, it may make sense to wait to claim full benefits.

Scenario 3: The High Earner

Margot, 63, earned more than her spouse throughout their 14-year marriage. Her own retirement benefit exceeds 50% of her ex’s, so she’ll likely want to claim her own. If she were to be widowed, though, survivor benefits could come into play and warrant a fresh review.

Scenario 4: The Divorced Widow

It is important to note that divorced widows have choices, if they have their own retirement benefit

They can file "a restricted application" applying for deceased ex-spousal benefit first.

They can switch to their own benefit later, if that exceeds the deceased ex-spousal benefit. This would include delayed retirement credits if claimed at age 70.

For example, Beth, 65, was divorced for 15 years when her ex-spouse passed away. Since their marriage lasted more than 10 years, she can claim survivor benefits—potentially up to 100% of his benefit. In some cases, clients in Beth’s position may want to start with the survivor benefit and switch to their own later, especially if they’re eligible for delayed retirement credits.

Helping Clients File with Confidence

While for many, filing for Social Security benefits isn’t complex and can happen right on the Social Security Administration’s website, that’s not the case for widow, widower, or surviving divorced spouse’s benefits. To file for those, your client will need to call 1-800-772-1213 or visit their local Social Security office. Here’s what to walk through with your client in advance:

Married 10+ years

Divorced 2+ years ago (if ex hasn’t filed)

Age 62+

Ex-spouse is 62+ or older and eligible for Social Security benefits

Currently unmarried

Document Collection

Proof of marriage and divorce

Basic identifying information for the ex-spouse

Earnings history (for comparing benefits)

Other, as needed

Filing

By phone or in person through the SSA

Often, the most productive conversations begin with: “What do you know about your Social Security options?” That opens the door for deeper clarity.

Clearing Up Common Misunderstandings

| Myth | Fact |

|---|---|

| "I didn’t work enough to qualify" | She may qualify through an ex-spouse’s record. |

| "My ex will get less if I file" | Claiming benefits based on an ex’s record does not affect their benefit. |

| "I can't file unless my ex has" | Not true. If divorced 2+ years, she can file even if the ex hasn’t. |

| "My ex will find out" | Claims are confidential. SSA does not notify them after 2 years of divorce. |

| “Benefits are the same whether my ex is living or deceased” | Not true. Benefits can differ significantly. Survivor benefits are often more generous compared to those available when the ex-spouse is still living. Retired-worker benefits linked to a living ex-husband's earnings can impact the financial outcomes for divorced women. |

| In a divorce decree, exes can prohibit each other from receiving Social Security benefits on each’s record | Not true. Social Security is governed by its own law, and any clauses outside of the law do not supersede it. |

| We lived together for 16 years, separated, and my partner recently passed away, can I apply for benefits on his record? | No. To qualify for surviving divorced spousal benefits you must have been legally married to the deceased worker for at least 10 years. |

| We divorced after 9 ½ years of marriage, are there any exceptions to the 10-year rule? | There are no exceptions to the duration of marriage rule, but there is a provision about remarriage, if that took place no later than the calendar year immediately following the calendar year of the divorce. |

Beyond Social Security: Filling the Income Gap

While Social Security can provide a steady foundation, it's rarely a complete solution—especially for women managing retirement on a single income. As many advisors have found, bridging the gap between early retirement and full benefits (or deferral to age 70) can require creativity and planning.

A well-placed annuity product can provide dependable income in the years before Social Security kicks in—or work alongside it to cover essential expenses like housing and utilities. A balanced, dividend-generating portfolio of other investment types can also provide income sustainably for years to come. Advisors should develop a personalized retirement income plan for their clients to ensure they are well-prepared to live out their golden years. This calculator is one tool to help uncover some of your clients’ retirement income needs.

FAQs: Social Security After Divorce

What if a spouse changes their name?

SSA requires legal documentation (like a birth certificate or court order) to confirm identity.

Can someone qualify if they stayed home while their spouse worked?

Yes—if they meet the 10-year marriage rule and are unmarried at age 62 or older, they may qualify for divorced-spouse benefits.

Does the ex-spouse need to be notified?

No. Claims on an ex-spouse’s record are entirely confidential and have no effect on the ex-spouse’s own benefit.

What happens if the ex-spouse passes away?

If the marriage lasted 10 years or more and the client is now unmarried, they may be eligible for survivor benefits—up to 100% of the deceased spouse’s benefit. The benefit is reduced if claimed before FRA, but in some cases, it makes sense to switch from survivor benefits to a personal benefit at age 70 (or vice versa), depending on which amount is higher.

A surviving ex-spouse can claim benefits based on the deceased's previous eligibility if the marriage lasted at least 10 years and the surviving ex-spouse is currently unmarried.

Why does earnings history matter so much?

Social Security benefits are calculated based on the client’s—or the ex-spouse’s—earnings history. Reviewing both is essential to help ensure the best possible outcome, especially in divorce situations.

Final Thought: You Don’t Have to Know It All

Helping clients make sense of Social Security, especially after divorce, can feel complex. But you don’t have to have every answer. What matters is creating space for the conversation, clarifying what’s possible, and partnering with trusted resources when needed. The Social Security Administration is a valuable resource for assistance and information on filing claims and understanding benefits.

And don’t forget – we’re here to help! Explore our National Sales Consulting offerings and reach out to your local wholesaler or visit delawarelife.com for more information.

Disclosures

1 Source: SSA.gov, https://www.ssa.gov/policy/docs/projections/populations/spousal-only-2050.html

2 Source: SSA.gov, https://www.ssa.gov/policy/docs/ssb/v83n3/v83n3p11.html

Delaware Life does not provide tax or legal advice. Any tax discussion is for general informational purposes only. Clients should refer to their tax professional for advice about their specific situation.

Delaware Life Insurance Company (Zionsville, IN) is authorized to transact business in all states (except New York), the District of Columbia, Puerto Rico and the U.S. Virgin Islands. Annuities are issued by Delaware Life Insurance Company and variable annuities are distributed by Clarendon Insurance Agency, Inc. (member FINRA) located at 230 3rd Avenue, Waltham, MA 02451. All companies are subsidiaries of Group 1001 Insurance Holdings, LLC and are responsible for their own financial condition and contractual obligations. Guarantees are backed by the financial strength and claims-paying ability of the issuer. Product availability and features may vary by state.

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC