The numbers are staggering: Over the next two decades, more than $84 trillion will be passed from older generations to their heirs, charities, and causes, according to studies done by Cerulli Associates. It’s being called “The Great Wealth Transfer”—and it’s one of the most significant financial events in modern history.

But this moment isn’t just about money. It’s about intent, communication, and the opportunity to plan with purpose. As someone who works closely with advisors across the country, I can tell you: clients are thinking about more than rates of return. They’re thinking about legacy. The latest 2025 Generational Wealth Transfer Consortia Report by LIMRA showed more than 80% of benefactors want more than just financial products—they're looking for more holistic support on everything from tax strategies to personalized estate planning.

Why Wealth Transfer Matters Now

Clients aren’t just asking about retirement anymore—they’re thinking about how their story will be carried on. And so are their beneficiaries, with 70% of them expecting an inheritance to provide the basis for a stable financial future (LIMRA 2025). Family wealth can play a significant role in achieving specific financial goals, such as purchasing a home or starting a business, and proper planning is essential for effective management.

Advisors should be prepared to work with clients to answer hard questions, like:

How do I pass wealth without triggering unnecessary taxes?

Are my heirs financially prepared?

What happens if I become incapacitated?

These are complex questions. And the answers aren’t in a brochure—they’re in the planning conversations you help lead. Here's a conversation framework that can help advisors navigate these tricky questions.

At Delaware Life, we support advisors with the tools, products, and real-world frameworks to help simplify wealth transfer planning—for you and your clients. Login or sign up to access our library.

1. Start with Intent: What Does Legacy Mean to Them?

Legacy means something different to every client. One of the most powerful ways to begin is simply to ask: what do you want your wealth to accomplish?

Is it:

Supporting children or grandchildren?

Donating to charitable causes?

Preserving a family business?

This is about more than dollars. It’s about values. These early conversations help uncover not just goals, but family dynamics. In fact, I often tell advisors: don’t be afraid to ask clients what they want their heirs to say about them one day. That mindset shift turns planning into something deeply personal and actionable.

Additionally, consider how your clients like to communicate and what gets them excited. Are they more interested in the hard numbers, or are they looking to hear that their heirs will be taken care of with their estate? Then, lean into that.

2. Inventory the Estate: Get the Full Picture

Before you build a wealth transfer strategy, make sure you have a clear view of what your client actually owns. Sometimes the most valuable service is simply giving clients a gentle nudge to review what they haven’t thought about in years.

Start with the big stuff: real estate, investment accounts, and retirement savings. That might include their primary residence, any rental or vacation properties, individual or joint brokerage accounts, CDs, and IRAs or 401(k)s. If it’s tied to long-term growth or income, it belongs on the list.

Next, ask about business interests. Clients may own shares in an LLC or S-corp, or operate a family business. If the business is part of their estate—or if it funds their lifestyle—it needs to be part of the plan. This is also a chance to ask whether a succession or exit plan exists. Do they want to pass the business on to their heirs? It’s important for advisors to be sensitive to this portion of the family legacy when creating a plan.

Don’t forget annuities and other fixed income products. These often get left off the estate planning radar, even though they can play a key role in income continuity or legacy protection. Make note of each contract, who owns it, who the annuitant is, and whether there are any guaranteed income or death benefit features still in place.

Finally, double-check beneficiary designations and account titling. This is one of the most common places things break down. Review POD/TOD accounts, retirement plans, and life insurance policies to make sure they align with the client’s will or trust. Even small mismatches can create big problems for heirs.

A complete inventory doesn’t just help with tax planning—it creates a moment to tap into what the clients really want their legacy story to be. How do they want their story to be told, and what do they want to be remembered by?

3. Structure the Strategy: Trusts, Gifting, and More

No two clients are alike. That’s why every wealth transfer strategy should be tailored—blending lifetime giving, trust planning, and thoughtful distributions after death.

Common tools to consider:

Revocable and irrevocable trusts

Charitable remainder trusts or donor-advised funds

Annual exclusion gifts, up to $18,000 per recipient in 2024

Upstream gifting to reduce future estate exposure

Spousal Lifetime Access Trusts (SLATs), which provide access to trust assets while offering significant estate planning advantages

For more information to support your practice, visit AdvisorNext.

4. Facilitate Client–Heir Communication

Even the best strategies can fall apart without communication. And in many families, that’s the hardest part.

Often, initiating the conversation about legacy planning can be difficult for clients. When you bring up the subject, watch the way a client reacts when you mention their heirs’ matters. Do they close off? Get anxious? That tells you something about their mindset. And if you do interact with the heirs, how are their reactions different or the same as their benefactors?

To help facilitate client-heir transparency, you can offer:

Family meeting templates

Discovery worksheets

Joint review sessions with heirs

Even better? Invite heirs to a free planning session. Help them understand what you do for their parents—and what you can do for them. That’s how you build multi-generational trust.

This is also a great time to lean into technology solutions as many Millennials and Gen Z-ers show a strong desire for online courses, tutorials, and financial planning tools. And, for the 60% of beneficiaries overall not seeking professional financial advice, easy-to-use, guided digital resources can be attractive to heirs (LIMRA 2025).

5. Coordinate the Legal Side

You play a key role in helping clients get organized and connected to qualified professionals. This includes making connections with attorneys, professional co-trustees, and tax experts, making sure your clients have finalized or updated essential documents like wills, powers of attorney, and trusts.

Including a trusted tax advisor in discussions around estate taxes and financial planning is especially crucial to ensure efficient wealth transfer and minimize tax burdens. Attorneys ensure that the client’s intentions are legally documented and enforceable. Without their input, even the best financial plan can be vulnerable to legal challenges, probate delays, or misaligned beneficiary designations.

In that vein, it’s imperative to verify that beneficiary designations are up to date and consistent with the estate plan. Even the best-drafted trust or will can be derailed if account titles or beneficiaries don’t match. Encourage clients to consolidate these documents in one accessible location, so they—and their heirs—aren’t scrambling when the time comes.

And when you refer to estate attorneys or CPAs? Make the expectations clear. Set deadlines, loop the client into the communication, and follow through. That kind of leadership not only protects the integrity of the plan—it reinforces your value as a long-term, trusted partner.

6. Navigate the Tax Landscape with Confidence

A thoughtful plan should always address tax exposure. The implications of estate taxes on wealth transfer are significant, and minimizing tax burdens is crucial for effective planning.

Help clients prepare for:

Estate tax thresholds ($13.61 million per individual for the 2024 tax year)

Capital gains tax and step-up in basis rules

Income tax on inherited IRAs, especially under SECURE Act 2.0 rules

Gift tax limits

Roth conversions to build tax-free legacy assets

When the stretch IRA went away in 2019 with the SECURE Act 1.0, many advisors shifted toward annual Roth conversions. It’s a strategy that can reduce tax burdens on heirs while creating flexibility for retirement.

Annuities can help here, too. They provide predictable income and can be used to meet RMDs efficiently—freeing up other assets to grow or transfer.

7. Build the Right Support Team

Trustee selection can make or break a plan. Advise clients to consider individual trustees like family members or close trusted friends to keep the client’s personal values in focus. Adding trustees that are professionals from banks or trust companies that can offer continuity for the plans while staying neutral. A co-trustee model may be the best way to combine professional guidance while maintaining a personal connection to the legacy.

And if they don’t have children or direct heirs? Charitable giving strategies can turn their wealth into long-term impact. Again, it all goes back to understanding what legacy really means to them.

For many families, your advice here prevents long-term friction—and ensures the strategy holds up.

8. Create a Review Timeline

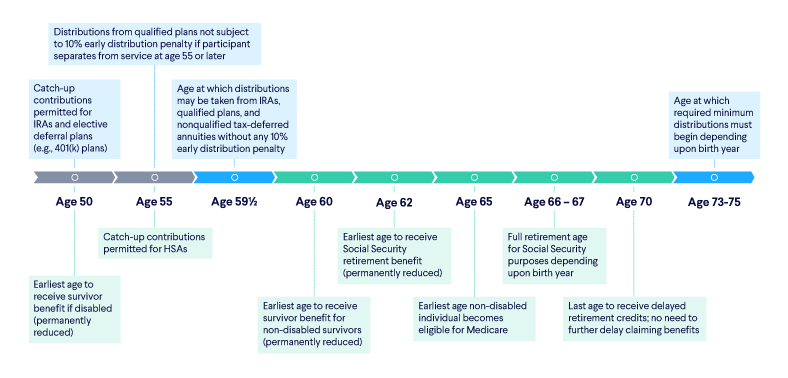

Life changes. So should the plan. But your plan should take into account key retirement milestones as well as major client life events to guide and prioritize client time.

Encourage clients to plan:

Annual reviews: During these reviews, it's crucial to evaluate the client's overall financial situation to ensure their plan remains aligned with their goals, and to make any necessary adjustments.

Updates after life events (marriage, divorce, new grandchildren, etc.)

Check-ins ahead of tax law changes

When updating the estate plan, always consider the client's financial situation to make informed decisions that reflect their current and future needs.

LIMRA’s 2025 study found that 90% of beneficiaries are open to working with their Benefactors’ financial advisor. Estate, tax, and wealth transfer planning are all key milestone opportunities to reinforces your role as the long-term steward of their family’s financial wellbeing. Proactive check-ins and annual touchpoints build long-term confidence in your firm across generations.

Advisors often ask me, "Is it worth building relationships with heirs if they don’t have assets yet?" My answer: absolutely—as long as you set expectations and use a service model that works for your business. In many cases, it’s not about giving the kids full planning services today. It’s about planting seeds that grow into long-term relationships.

The Advisor Advantage: More Than a Plan—A Partnership

The Great Wealth Transfer isn’t a trend—it’s a defining chapter in your clients’ financial journey. Wealth planning is crucial in developing strategies for effective wealth transfer, tax reduction, and charitable giving.

And when it’s done right, your role isn’t just technical—it’s transformative. You become the guide that carries their story forward. The one they trust to help the next generation do more than inherit assets—but understand how to use them.

At Delaware Life, we’re here to help you meet that moment—clearly, confidently, and with no bells and whistles. Just pure value. Get more professional resources by creating an account with Delaware Life today.