Key Takeaways

• Prioritize What Matters Most: Focus on tasks that have the greatest long-term impact—like deepening client relationships and strategic growth—instead of just reacting to urgent demands.

• Use Time Management Frameworks: Tools like the Eisenhower Matrix can help advisors categorize tasks by urgency and importance, enabling smarter daily decision-making.

• Create Efficient Workflows: Standardize and document repeatable processes (e.g., onboarding, reviews) to save time and improve client service scalability.

• Leverage Technology Thoughtfully: Use CRM systems, automation tools, and scheduling apps to streamline operations—while maintaining a personal, trust-based client experience.

• Protect Your Time and Energy: Time-blocking, delegation, and weekly reviews help manage energy, avoid burnout, and ensure advisors spend their best hours on high-value work.

Our time isn’t just a resource—it’s the foundation of our client relationships, business growth, and peace of mind. Most advisors aren’t struggling with laziness. They’re struggling with doing too much. Too many meetings. Too many urgent requests. Too much noise. And in all that movement, it’s easy to feel like you’re running a mile a minute—but still falling behind.

I hear it all the time: "I was busy all day, but I can’t tell you what I actually accomplished." That’s not a time problem. That’s a prioritization problem. And solving it doesn’t start with better to-do lists—it starts with getting clear about what your time is really worth.

Prioritize What Builds Value—And Let Go of What Doesn’t

Not everything on your calendar deserves equal weight. High-performing advisors learn to triage their days based on impact, not just urgency.

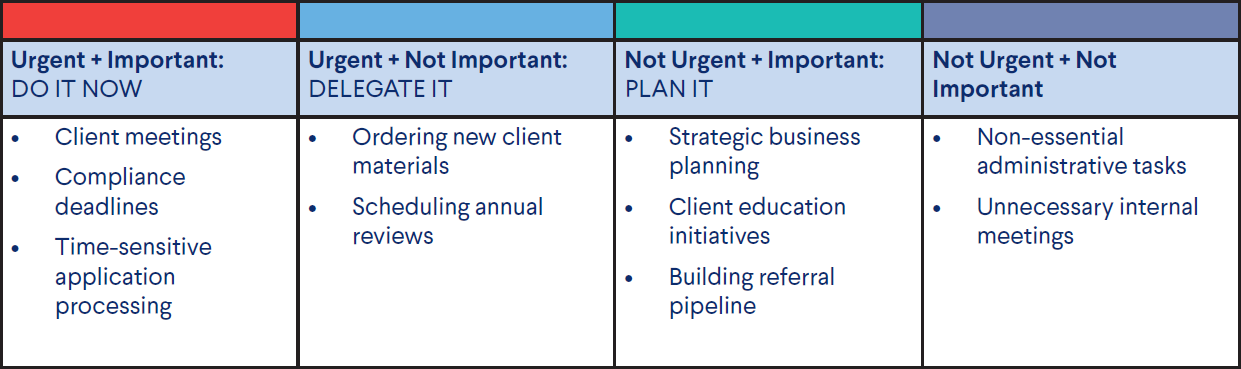

Stephen Covey’s time management matrix is a timeless tool, based on and adapted from the Eisenhower Matrix. The Matrix essentially classifies tasks to prioritize which actions will have the biggest long-term impact. An advisor’s matrix might look like this:

In my experience, financial professionals benefit from thinking about their tasks on three levels:

Urgent: These are the fires. The things you feel can’t wait.

Important: These are the tasks that support your growth and client success.

Greatest Significance: These are the efforts that shape your legacy, grow your business long-term, and deepen trust with clients.

The challenge? Most advisors live in the Urgent and spend too much time on fires and too little time focusing on greatest significance. That’s where burnout hides.

"When I spend a day in the weeds, I go home tired. But when I spend a day focused on what matters most—improving our client experience, mentoring the team, shaping our strategy—I go home fulfilled."

That kind of clarity doesn’t happen by accident. It starts with an honest weekly review. What are the 2-3 things that would have the most long-term impact on your practice? Block time for those and focus on high value tasks that can significantly improve productivity and lead to better outcomes, freeing up time otherwise spent on lower-value activities.

Consider your weekly schedule and try to determine where your time is spent, such as:

| Type of Task | Definition | Examples |

|---|---|---|

| Urgent & Important | Time-sensitive and critical | Client emergencies, compliance deadlines |

| Important, Not Urgent | Valuable but often postponed | Client outreach, planning |

| Greatest Significance | Deeply fulfilling and transformative for your practice | Long-term growth initiatives, improving client experience, team development |

Advisors can start to separate their daily tasks by overlaying a client-first approach to the Matrix. Ask yourself:

Is this task deepening a client relationship?

Is it growing the business?

Can it be streamlined or delegated?

"Something like legacy planning work often lives in that 'greatest significance' category," Anders Smith, Vice President & Managing Director of National Sales Consulting reminds us. "It’s not urgent, but it’s deeply meaningful—to clients, and to the advisor who helps shape it." Whether you're helping clients articulate their story, set up charitable giving, or prepare for intergenerational transitions, that’s time well spent.

Turn Repeatable Tasks into Efficient Workflows

Strong financial advisor workflows aren’t about rigidity. They’re about consistency made efficient. Consistency saves time—but only when it’s intentional. The best-run practices don’t just react to requests. They build workflows that make client service predictable and scalable.

Start by mapping your key workflows—onboarding, product discussions, annual reviews—and ask:

What steps do I always repeat?

What can be templated, pre-filled, or systematized?

A significant portion of an advisor's work takes place behind the scenes and can be automated to free up more time for high-value interactions with clients. Streamlining client onboarding can save time and improve efficiency by reducing repetitive tasks and clarifying the experience for clients.

Simple tools like client checklists or pre-packaged product materials (such as Delaware Life's advisor kits) are small investments that save time across dozens of meetings. And if you’re doing something consistently, you should write down the process you follow so your team can handle it even if you’re unavailable. When you’re not reinventing the wheel, you can spend more time listening and serving your clients.

Use Smart Technology—But Keep It Human

The tech you use should work for you and make your workflow better – not add complications. Start simple:

CRM automation: Set up reminders for follow-ups and birthdays; schedule your marketing emails in series

Scheduling tools: Cut down on back-and-forth using tools like Calendly or YouCanBookMe

Form automation: Pre-fill repetitive fields in onboarding and applications

I’m not a tech-first guy. But I’ve learned to appreciate how the right tools can protect my time and improve my focus. Use your CRM to automate reminders. Use Calendly to cut down on back-and-forth. But don’t let automation replace your presence. In a business built on trust, you can’t outsource connection. Your differentiator is trust—and technology should amplify that, not undermine it.

Here, Smith also recommends using visual planning tools or sample documents to facilitate smoother, less confrontational discussions. "Seeing something in black and white helps clients process decisions more calmly," he says.

As he puts it, "Technology should make things faster—but clients still want to feel known."

Time-Block for Growth, Not Just Maintenance

One of the simplest yet most overlooked time management tips? Protecting time on your calendar as if it were your client’s.

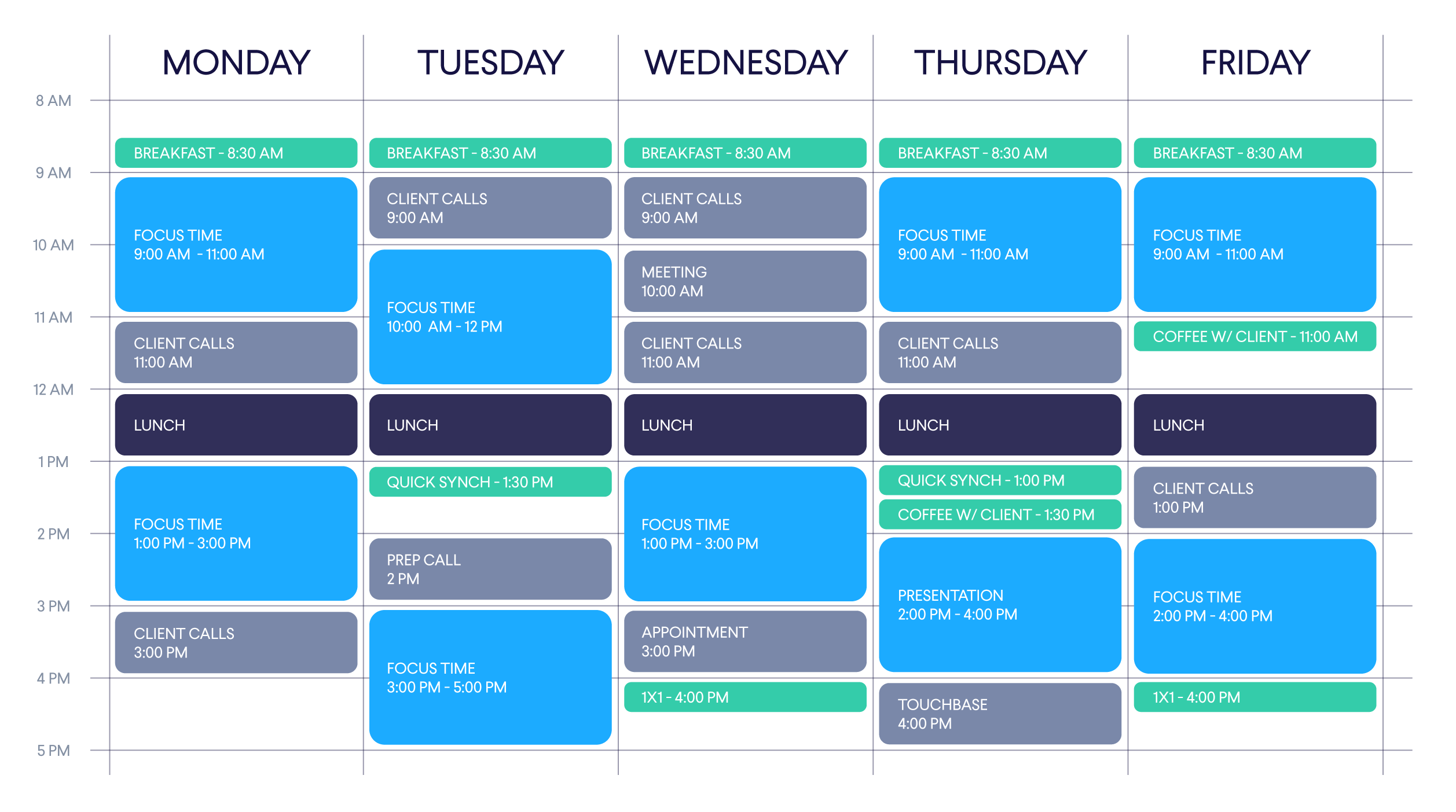

Time-blocking—reserving intentional blocks of time for specific tasks—lets you build a rhythm. Most advisors fail at time-blocking because they try to over-structure their day. What works? Three to five flexible blocks per day. Each block should last 20 to 45 minutes, focused on one category of work, such as:

1–2 hours per week for client outreach

Standing prep windows for annual reviews

Dedicated “CEO time” to work on your practice, not just in it

Make one of those blocks a "greatest significance" session each day. For me, that might mean prepping our next strategic push. For you, it might be mapping your referral pipeline or developing your next hire. Whatever moves your practice forward—protect time for that like you would for a client meeting.

Like product design, the less clutter you allow, the more focus you unlock. You can start slowly to take back your calendar; consider auditing your past quarter of calendar obligations and see what you can remove, decrease or streamline for your next quarter.

It’s also paramount that you create a team culture that supports time blocking -- that means respecting time blocks, supporting team workflows, and not hesitating to pass the baton when needed. Delegation isn’t just a time-saver. It’s a signal of trust. It tells your team: you’re empowered to own this.

Delegate What Keeps You Stuck

Another effective way to protect your time is by being intentional about who you spend it with. Smith recommends a simple but often overlooked strategy: client segmentation.

By dividing your client base into tiers (such as A, B, and C-level clients), you can align your service model to match the value each segment brings to your practice. Top-tier clients might receive more frequent touchpoints and customized planning, while lower tiers may be better served by streamlined, systematized engagement.

“Don’t over-service clients whose revenue doesn’t justify extensive time investment,” Smith advises. “It’s about making your time work harder—not working harder with every client.”

He also recommends rethinking client appreciation strategies. Rather than hosting one large event for all clients, consider flipping the model: invite your A-level clients to host a smaller, high-impact event (funded by you), where they bring friends and peers.

“That way, you spend your best energy where it matters most—and your best clients become your best advocates,” Smith explains.

This targeted, time-efficient approach helps advisors manage their bandwidth while still deepening trust with their most valuable relationships.

If a task doesn’t require your unique skillset, it’s a candidate for delegation. Start small:

Data entry? Delegate.

Document formatting? Delegate.

Scheduling logistics? Delegate.

Not every advisor has a support team—but the small cost to offload tasks using freelance administration, outsourced paraplanning, or virtual assistants can make a big difference to your clients and your practice.

Here’s a small example from our practice that changed everything:

Instead of letting client callbacks turn into a 3-call loop, try booking the follow-up while the client is still on the line. They say, "Mary has openings at 2 or 4 today—which would you prefer?" That small shift saves hours over the course of a week. It also tells the client, we’re prepared, we prioritize you and make your time worthwhile.

"Delegation isn’t about handing off the grunt work. It’s about creating space to do your best work."

Energy Is a Business Asset—Manage It Like One

Burnout is real—and it’s one of the most silent threats to long-term advisor productivity. Time management isn’t just about doing more. It’s about protecting your energy for the moments that matter, especially in the remote-first world. Effective time management also plays a crucial role in maintaining work-life balance, helping to prevent burnout and allowing advisors to prioritize their well-being.

Dedicating specific time segments to a specific task can significantly enhance productivity by ensuring that high-value client work is prioritized over lower-value activities.

Build margin into your calendar. Avoid back-to-back meetings when possible. Take five minutes between calls to reset. Your clients will feel the difference—and so will you.

Quick Wins for Your Week

If you’re looking for low-lift, high-impact ways to take back your time, here are a few advisor-tested strategies to start using immediately:

Start with a “Top 3” Daily Focus: Each morning, jot down the three most important things to complete that day. Not the most urgent—just the ones that move your practice forward.

One priority per category: client, growth, process.

Batch Similar Tasks: Group meetings, follow-ups, or planning tasks together. Shifting between task types costs more time than most advisors realize.

Handle all client email replies from 10:30–11:00, after your first meeting block.

Limit “Check-In” Interruptions: Ask team members to hold non-urgent requests for scheduled daily huddles or use a shared “to discuss” doc. This keeps your focus intact without dropping the ball.

Fewer one-off interruptions = more flow, fewer errors.

End the Week With a 15-Minute Review: On Fridays, review your calendar, wins, and energy levels. Schedule next week’s “greatest significance” blocks while it’s still fresh.

You don’t have to control everything. But you can design the parts that matter.

Use Templates as a Thinking Shortcut: If you write, explain, or prep something more than three times a year—template it. Client emails, meeting agendas, onboarding guides—it all counts.

Templates aren’t lazy—they’re a sign of discipline.

Time Well Spent Builds Trust

We know the real value in an advisor’s day is measured in trust—not task volume. Smart time management isn’t about squeezing more into your day. It’s about clearing space for deeper client relationships, strategic growth, and lasting trust. When you prioritize what matters most, streamline what can be systematized, and protect your energy for your clients, you’re doing more than managing your schedule—you’re building a business that lasts.

Disclosures

Delaware Life does not provide tax or legal advice. Any tax discussion is for general informational purposes only. Clients should refer to their tax professional for advice about their specific situation.

Delaware Life Insurance Company (Zionsville, IN) is authorized to transact business in all states (except New York), the District of Columbia, Puerto Rico and the U.S. Virgin Islands. Annuities are issued by Delaware Life Insurance Company and variable annuities are distributed by Clarendon Insurance Agency, Inc. (member FINRA) located at 230 3rd Avenue, Waltham, MA 02451. All companies are subsidiaries of Group 1001 Insurance Holdings, LLC and are responsible for their own financial condition and contractual obligations. Guarantees are backed by the financial strength and claims-paying ability of the issuer. Product availability and features may vary by state.

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC