Help your clients prepare for the effects of rising costs in retirement

Retirees spend approximately 40% of their income on housing and healthcare - two of the highest-inflation categories.

Source: Employee Benefit Research Institute (EBRI)

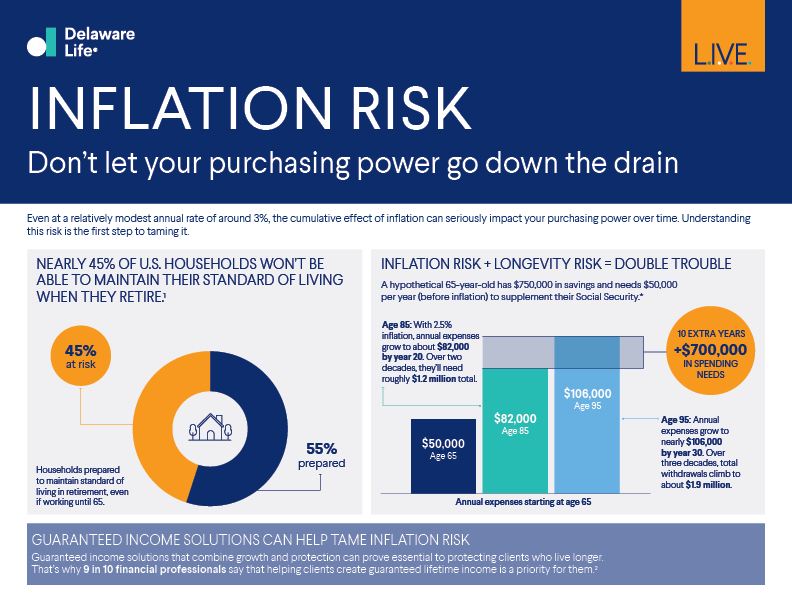

Many of us underestimate the eroding effect inflation can have on our savings over time. Yet retirees may struggle to maintain their desired lifestyle as living expenses such as food, housing, and healthcare continue to increase over time, eroding their savings. Over a 20- to 30-year retirement, that erosion, sometimes called purchasing power risk, can dramatically change a client's lifestyle. Your job is to help clients understand that risk and help them retain their purchasing power — and dignity — in retirement.

The tools and resources on this page are here to help. Start with this client-friendly video and then share it with your clients to make an impact.

Retirees spend approximately 40% of their income on housing and healthcare - two of the highest-inflation categories.

Source: Employee Benefit Research Institute (EBRI)

That's how much the cost of some common grocery items increased over the most recent five-year period.

Source: Delaware Life Research

Use this with your clients to estimate their day-to-day expenses and income sources in retirement.

What do your clients need to keep in mind when it comes to health care costs in retirement? This customizable guide lays it all out.

Share this overview of the four L.I.V.E. risks to educate your clients.

Use this infographic with your clients to give them an easy, visual way to understand the impact inflation could have on their retirement.

Use this calculator with your clients to estimate how much more income they may need when factoring in the effects of inflation.