Help clients plan for retirement income that lasts as long as they do

A 65-year-old couple has a 47% chance that one spouse will live to age 95.

Source: Social Security Administration (SSA)

The good news: Advances in medicine and healthier lifestyles mean that people are living longer than ever.

The not-as-good news: Increased longevity means increased longevity risk. The reality is your clients could spend as much or more time in retirement than they spent at work. To reduce the risk of outliving their savings, they may need to grow it to last for 30+ years of retirement income — especially if they, like many people, end up retiring earlier than they had planned.

As a financial professional, you're on the front line of helping people rethink how long their money needs to last. The tools and resources on this page are here to help. Start with this client-friendly video and then share it with your clients to make an impact.

A 65-year-old couple has a 47% chance that one spouse will live to age 95.

Source: Social Security Administration (SSA)

That's the percentage of Americans who may not be able to maintain their current lifestyle in retirement.

Source: The Vanguard Retirement Outlook, 2025

This brief article explores using an annuity to pay for long-term care insurance.

What do your clients need to keep in mind when it comes to health care costs in retirement? This customizable guide lays it all out.

Use with your clients to estimate their day-to-day expenses and income sources in retirement.

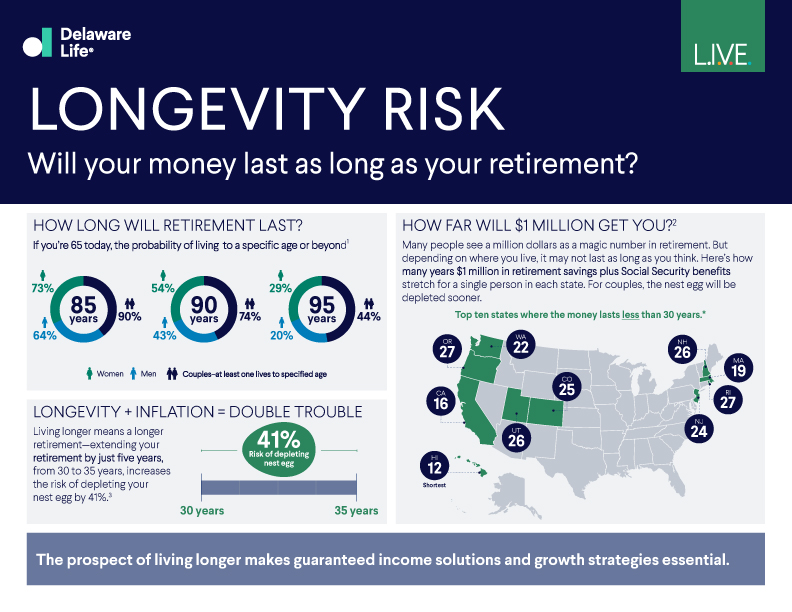

Use this infographic with your clients to give them an easy, visual way to understand the impact longevity could have on their retirement.

Use this calculator with your clients to estimate their Social Security benefit. For more Social Security resources, visit delawarelife.com/content/advisor-next.