Help clients make decisions with calm and clarity

More than 60% of Americans believe the U.S. is in a recession — even when GDP, employment, and wages say otherwise.

Source: CivicScience Economic Sentiment Tracker

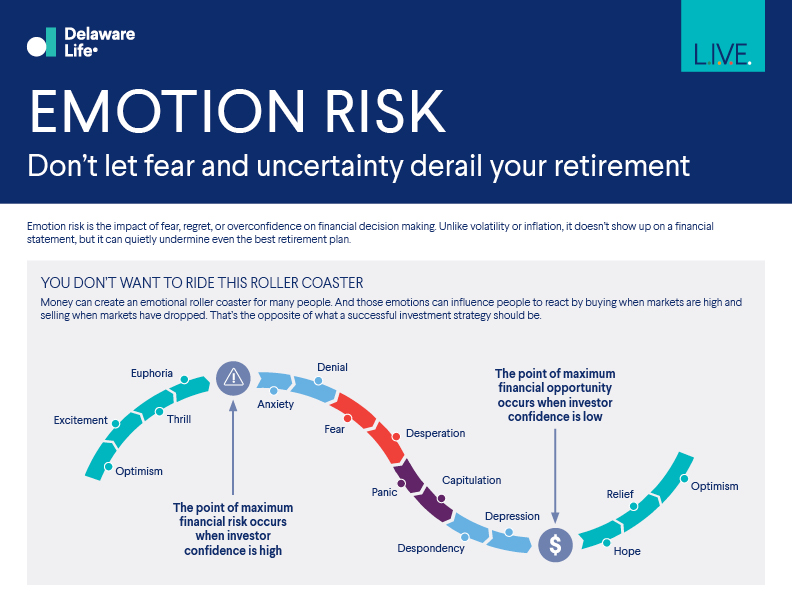

Emotion risk is the impact of fear, regret, or overconfidence on decision-making. Unlike volatility or inflation, it doesn’t show up on a financial statement, but it can quietly undermine even the best retirement plan.

Retirement is an emotional, not just financial, experience: Identity loss, changing routines, and health concerns influence how clients make decisions. And when clients let their emotions (not strategy) take the driver’s seat, mistakes often happen.

That's where you come in. By helping clients recognize and manage emotion risk, you can help protect them from making impulsive decisions that jeopardize their long-term security. The tools and resources on this page are here to help. Start with this client-friendly video and then share it with your clients to make an impact.

More than 60% of Americans believe the U.S. is in a recession — even when GDP, employment, and wages say otherwise.

Source: CivicScience Economic Sentiment Tracker

Among people who own a guaranteed lifetime income annuity, 71% feel better about protection from market downturns.

Source: Greenwald Research 2025 Retiree Insights Survey of Consumers

Learn to recognize your clients' buying styles and adapt your communication and approach accordingly.

Effective tips and strategies for communicating with clients about market volatility.

Use with your clients to estimate their day-to-day expenses and income sources in retirement.

Use this infographic with your clients to give them an easy, visual way to understand the impact emotion risk could have on their retirement.

Turn anxiety into actionable insights with this tool to estimate how much clients should be saving for retirement.